Living on the 50-30-20 Budget Rule

If you’re reading this, you are probably scrambling your brains about the uncertainty of the current economy and how to stay afloat when it comes to your budgeting needs. For a nomad like me who’s been moving about because of job opportunities, most of my monthly budget is spent on rent.

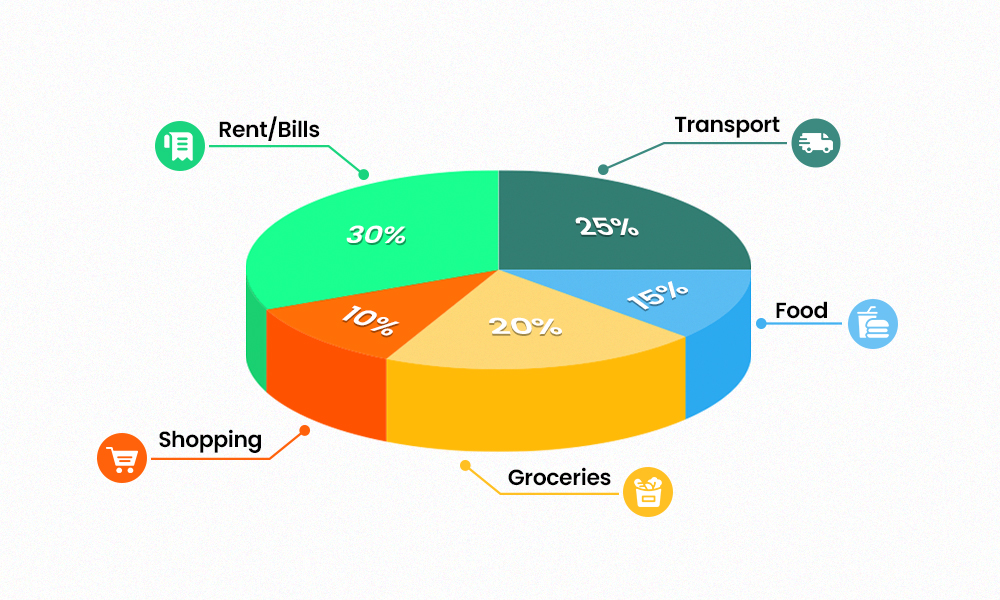

This division can obviously vary from person to person but the 50-30-20 budgeting rule generally eases the financial pressure and allows one to stay on top of their monthly budgeting needs.

So what’s the rule exactly? Keep reading.

1. Spend 50% on Necessities

Make it a habit to set aside 50% of your income for the necessities you need to pay for each month including your rent of course. Necessary expenses can include:

- Utilities (water, gas and electricity)

- Phone and Internet connection

- Public Transport/ Car Fuel

- Groceries

- Prescriptions

2. Spend 30% on Wants

You definitely need to maintain a social lifestyle so don’t feel guilty to set aside some budget on shopping or dining out experiences with friends, colleagues and family. Once in a while, it’s alright to splurge on what the heart wants!

3. Save 20% for a rainy day

When your paycheck comes in, don’t forget to put money into your savings/emergency fund first, for any unexpected expenses that may occur in the future. If you wait until the end of the pay period, there’s a good chance there won’t be as much left to save.

In the end it’s important to note that it’s better to adjust your budget to accommodate for your expenses - don’t simply pay outside your means and hope for the best and secondly, don’t compare your budgeting needs to your friends and colleagues because everybody’s financial situation is completely different.

By Farheen Qureshi

Speak to an expert who can walk you through the way Finja Business can benefit your specific situation

Sign Upto get access for Finja Business instantly