Transform your Business with Payroll Plus & Digital Payments

Any idea that displaces existing markets and traditional business models and creates new alliances and value networks, is identified as disruptive. Disruptive innovation has been called the most influential business idea of the 21st century. The idea is that as companies tend to innovate faster, most organizations eventually end up producing products or services that are actually too sophisticated, too expensive, and too complicated for many customers in their market. They pursue selling these innovations to the higher tiers of their markets because this is where they have earned the highest revenues. However, by doing so, companies inadvertently open the door to “disruptive innovations” at the bottom of the market. An innovation that is disruptive allows a whole new population of consumers at the bottom of the pyramid access to a product or service that was historically only accessible to consumers with a lot of money. Because these lower tiers of the market offer lower gross margins, they are unattractive to other firms moving upward in the market, creating space at the bottom of the market for new disruptive competitors to emerge. A study from the John M. Olin School of Business at Washington University estimates that 40% of today's Fortune 500 companies on the S&P 500 will no longer exist in 10 years.

The combination of new technologies (blockchain, virtual reality, cryptocurrencies, digital payments, Internet of Things), new business models (Uber, Air BnB, Alibaba), consumer expectations, and the pressure on cost and performance, is creating the perfect storm. It will lead to most companies having a Kodak, Nokia or BlackBerry moment unless they quickly evolve and digitize.

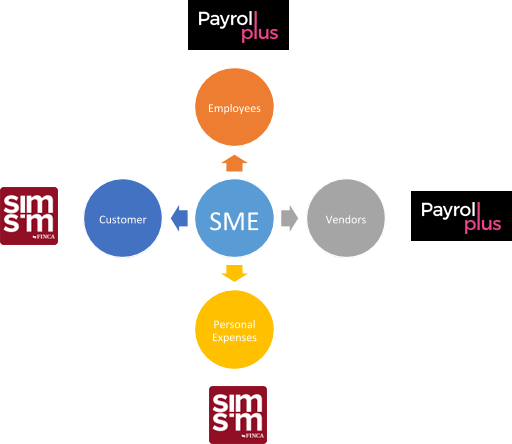

Small and Medium Enterprises (SMEs) have a unique opportunity to digitize and disrupt competition. The idea is to take advantage of the new opportunity and defend the core business. By automating their day-to-day operations, they are able to create efficient processes, lower costs, increase quality, and enhance the user experience. Cash-based entities, which attempt to save taxes, just cannot compete! A company that pays its suppliers and employees via cash works on an inefficient system as moving money is costly and time-consuming. A “Just-In-Time” management of money causes instant payments to all the concerned stakeholders: suppliers, employees, banks, etc., inherently building documentation and efficiency into the system. SMEs can transform digitally, getting rid of cash, and becoming eligible for digital credit.

Transform your business digitally at zero incremental cost.

FINJA is paving the way for SMEs to transform digitally and reinvent customer relationship at zero incremental cost. The mobile wallet SimSim, a product of FINJA & FINCA Microfinance Bank, eliminates the fee on payments and gives users the freedom to transact digitally from anywhere, anytime. Coupled with Payroll Plus, a cloud-based organization management solution, the benefits for companies adopting digitization are endless. The belief is that partner SMEs can transform digitally at zero incremental cost, and have access to loans also. These are nano loans (asaan loan), merchant loans, and advance salary loans. Nano loans are individual loans that can be taken by any individual having a SimSim wallet. Merchant loans can be taken by merchants where FINJA will lend 50% of the sales amount as a credit line. This amount can be paid off via monthly instalments at a mutually decided rate. Advance salary loans can be taken by any individual where they get instant access to 25% of gross salary.

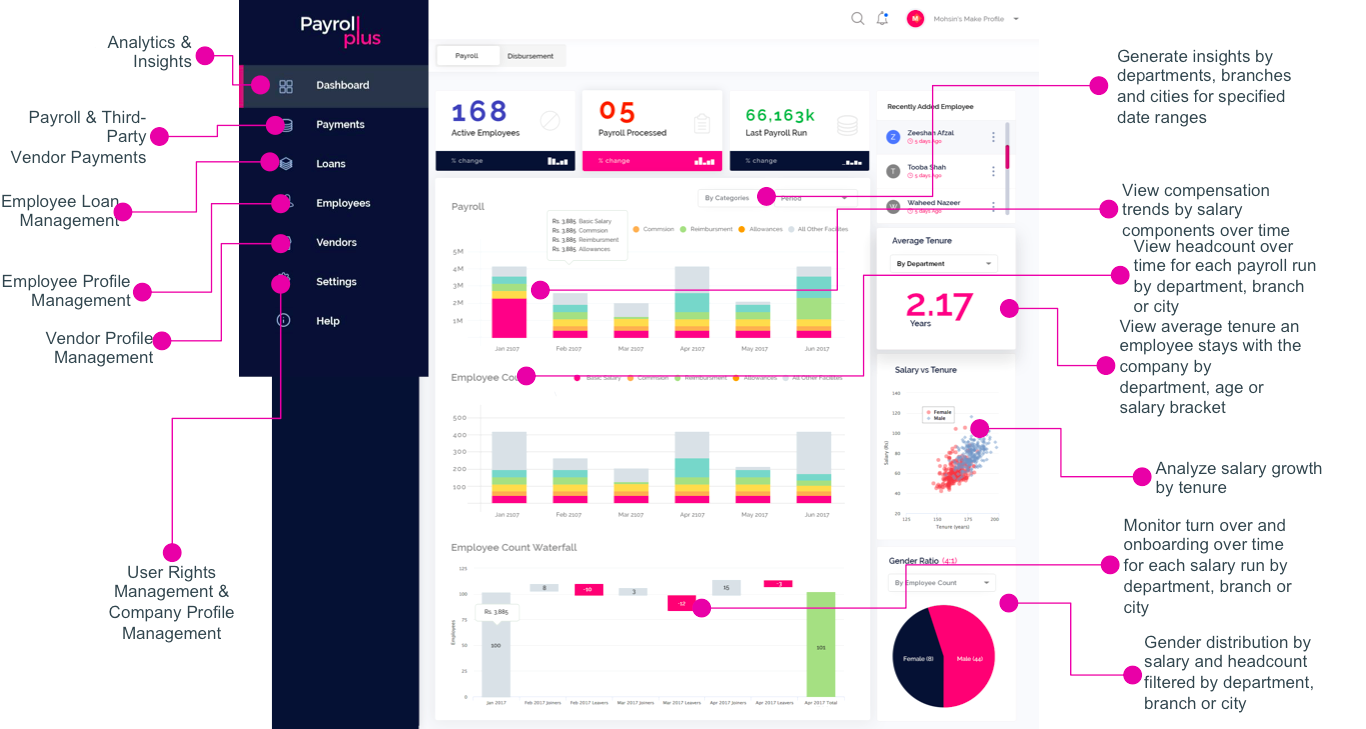

The top features offered by Payroll Plus are given in the table below.| Features | Benefits |

|---|---|

| Analytics & Insights | Track the organisation’s health & performance for the last 6 months |

| Payroll & Third Party Vendor Payments | Make payments for up to PKR 10 million to all vendors and third parties |

| Employee Loan Management | Know which employee has taken loans of what amount |

| Employee Profile Management | Employees profile can be managed and easily updated |

| Vendor Profile Management | Vendors profile can be managed and payments can be made real-time through Payroll Plus |

| User Rights Management & Company Profile Management | Self-management portal for employees for the generation of salary slips, payment history and company profile |

| Generate insights by department, branch, cities for specified period | Evaluate KPIs in a segregated way, so that strategies can be aligned |

| View compensation trends by salary components | Get an overview regarding the spending over time |

| View employee head count over time for each payroll run | Know how many people are employed in which department. Align departmental needs |

| View average tenure of an employee by department, age or salary bracket | Learn the employees’ reasons for motivation to stay or leave |

| Analyse salary growth by tenure | Assess the top performers |

| Monitor turnover & on-boarding over time for each salary run | Measure operational runtime |

| Gender distribution by salary and headcount | Become an equal opportunity employer |

With Payroll Plus, it’s easy to have businesses, products and services that are better – less expensive and more creative, useful and impactful – and scalable.

Payroll Plus: a complete organization management solution.

FINJA operates with the core belief that every partner relationship is a key strength. Instead of being a conventional business which gains in isolation, FINJA has deigned its business model with the intention to win alongside its partners: FINJA profits only when the partner business profits. With this view in mind, a team of dedicated Relationship Managers will support business owners to embrace Payroll Plus seamlessly. SMEs can easily get the Payroll Plus solution by using these channels.

- Visit http://finja.pk/Index

- Call 042-38100050

- Email at info@finja.pk

Speak to an expert who can walk you through the way Finja Business can benefit your specific situation

Sign Upto get access for Finja Business instantly